Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

Pandora Jewelry

The Spectacular Rise and Sudden Fall of Pandora

It was just 10 months ago that the Danish jewelry company, Pandora, was the darling of the jewelry industry and the investment world. The company, primarily known as the maker of extremely popular charms with broad appeal, issued an IPO that raised $2.1 billion in October 2010. Its subsequent earnings reports documented astonishing growth. But this all changed on Tuesday.

The company released its second quarter financial report two weeks early with less than expected growth as well as declines in major markets. It also drastically downgraded its sales and profits targets for 2011 and reported a drastic decline in July revenues. In addition, the company announced the sudden resignation of its CEO Mikkel Vendelin Olesen. The result was that its stock fell about 70 percent Tuesday to a record low of 39.30 kroner ($7.55), according to published reports. The company blamed rising commodity prices, which forced it to raise its prices, but also put the fault on “inadequate” execution.

“Although our price increases combined with some destocking are significant contributors to our slowdown in sales and profitability, our own inadequate operational sales, and marketing execution is as big a factor,” said Allan Leighton, Pandora board chairman.

Pandora board member Marcello Bottoli was named the interim CEO as the company seeks a permanent replacement.

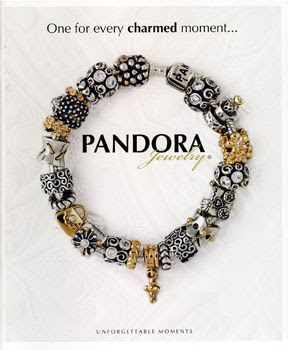

Pandora, founded in 1982, makes a full line of jewelry and watches but is known for its individually crafted charm designs made of silver, gold, gemstones and glass. They are highly prized by their customers who collect them to make their own jewelry creations, primarily bracelets. Charms are mostly popular with younger jewelry lovers because they allow customers to create multiple styles at a relatively low cost. But these creations, designed at the company’s headquarters in Denmark and manufactured in cost-friendly Thailand, appeal to all ages and are popular throughout the world. Its products are currently available in 55 countries on six continents through more than 10,000 points of sale, including 500 of its own branded stores.

Retailers loved them as they brought much needed business to their stores during the economic downturn and when the company chose to go public, investors swooned, creating one of the largest IPOs in 2010. A month later, the company said third quarter sales doubled and profits tripled.

However, on Tuesday, Pandora changed its 2011 outlook from expecting a revenue growth of no less than 30 percent to 0. It also noted that revenues fell 30 percent in July.

On the same day, Pandora reported that second quarter revenue increased 3.6 percent to 1.4 billion Danish kroner ($265.3 million). In the Americas, revenue increased 16.2 percent. This sounds good but sales in the U.S., its largest market, fell by 0.7 percent for the period. The U.S. accounted for 39.2 percent of all sales during the period.

No comments:

Post a Comment